The price of silicon metal rides a roller coaster, up and down all the time. It is sometimes difficult to predict what comes next. Just as weather varies, the price of silicon metal can also vary for a variety of reasons.

There’s one major factor that can cause the price of silicon metal to fluctuate, and that’s supply and demand. If you have more of that silicon metal around, then the price can come down. But if there is insufficient silicon metal, the price may rise. Other factors, such as revisions to trade rules or surprise events, can also impact the price of silicon metal.

Trade rules are sort of like rules of the road that countries use when they buy and sell things from each other. Occasionally these rules can change, and that may impact the price of silicon metal. The price could go up, for instance, if a country imposed a tax on imports of silicon metal. If a trade deal decreases taxes on silicon metal, the price might fall.

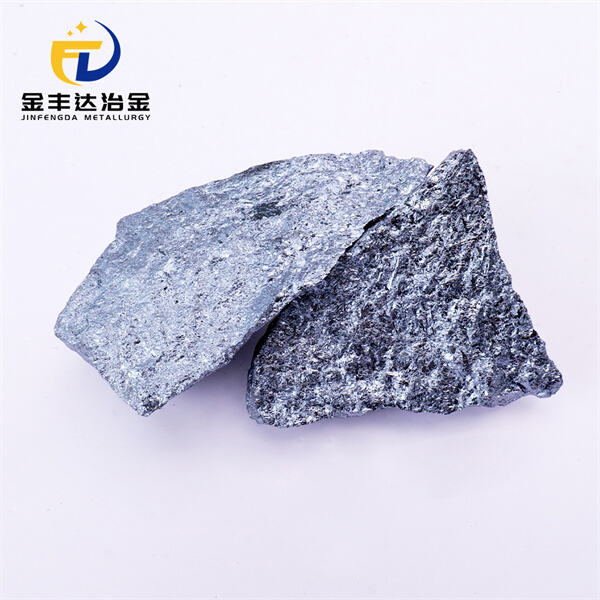

Silicon metal is immensely valuable in the tech world since it’s used to manufacture computer chips and electronics. Because tech is continuously advancing, the demand for silicon metal will probably continue to climb. This could indicate an increase in the price of silicon metal down the line.

There are also various methods to manage the disruption caused by fluctuating prices of silicon metal. One strategy is to purchase silicon metal when the price is low and store it for redemption during a future time in which the value is higher. The second is to participate in supply from different suppliers, so that if one source of silicon metal becomes too expensive, there are other alternatives. With preparation and information about the market, companies are well equipped to manage the risks associating with fluctuating silicon metal pricing.

Our 120,000-square-meter factory is equipped with 26,300KVA alloy refining electric furnaces and 8 intermediate frequency furnaces, ensuring robust production capabilities for a variety of metallurgical products including Ferro Silicon and Low Carbon Ferro Chrome.

We offer personalized metallurgical solutions tailored to client needs, backed by a 1-hour response guarantee via multiple channels (WhatsApp, WeChat, Email) and dedicated problem-solving throughout the project lifecycle.

We implement stringent quality control through in-house element testing and support third-party inspections (SGS, BV, AHK), ensuring our products meet international standards for purity and performance.

With over 20 years of export experience, we have successfully served markets in South Korea, Japan, Germany, Turkey, Russia, and beyond, providing timely delivery, strong logistics partnerships, and reliable after-sales support.